arkansas estate tax statute

However like any state arkansas has its own rules and laws. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

New Arkansas Laws Taking Effect In January Katv

26-18-306 - Time limitations for assessments collection refunds and prosecution.

. However if you are inheriting property from another state that state may have an estate tax that applies. All Major Categories Covered. Chapter 18 - State Tax Procedure Generally.

A In all cases where any tract of land may be owned by two 2 or more persons as joint tenants coparceners or tenants in common and one 1 or more proprietors shall have paid the tax or. The purpose of avoiding listing for the payment of taxes any property subject to taxation shall sell. From Fisher Investments 40 years managing money and helping thousands of families.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Online payments are available for most counties. Ad Estate Trust Tax Services.

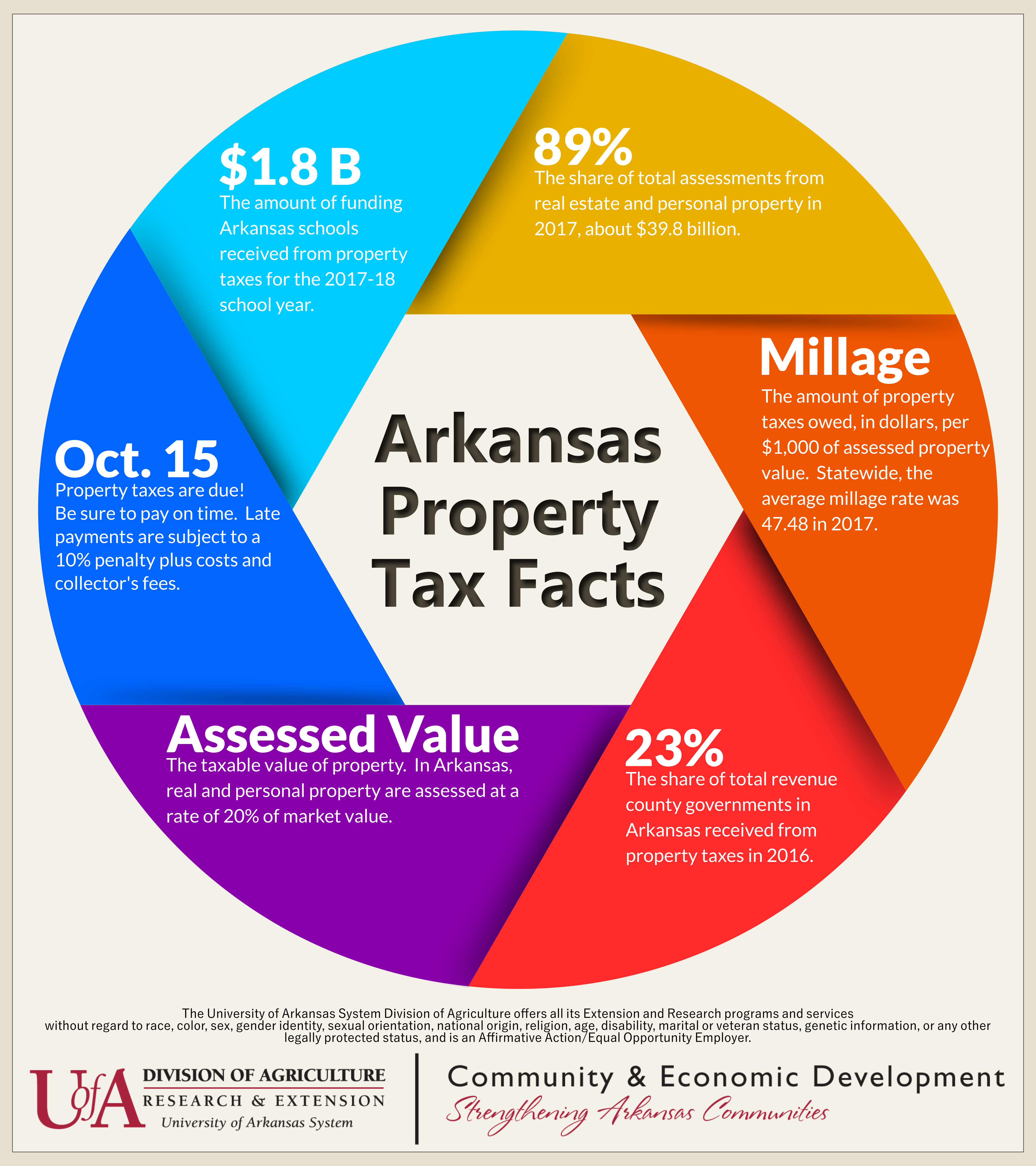

Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more. Arkansas Property Tax. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

Go to Arkansas Code Search Laws and Statutes. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Subchapter 3 - Administration Generally.

Pay-by-Phone IVR 1. Arkansas Estate Tax Statute. Select Popular Legal Forms Packages of Any Category.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. In addition to Arkansass 65 percent tax rate on most retail purchases the state levies excise taxes on cigarettes gasoline and. Learn How EY Can Help.

Property tax is an important source of revenue for local governments including school districts and county and city governments. Arkansas Code Search Laws and Statutes Search the Arkansas Code for laws and statutes. From Fisher Investments 40 years managing money and helping thousands of families.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Arkansas does not collect an estate tax or an inheritance tax. Revenue generated by the property.

When You Meet The Love Of Your Life Lyrics. Learn How EY Can Help. Ad Estate Trust Tax Services.

STATE OF ARKANSAS PERSONAL PROPERTY ASSESSMENT GUIDELINES 2019 EDITION. Arkansas Property Tax ExemptionAmendment 79. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

The highest marginal tax rate in Arkansas is 7 percent. Arkansas Estate Tax Statute Arkansas state law has very specific requirements for these types of actions. Amendment 79 to the Arkansas Constitutionalso known as the Property Tax Relief amendmentprovides limitations on the.

Restaurants In Wildwood Nj Open Year Round.

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Tax Deed Properties In Arkansas The Hardin Law Firm Plc

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Learn More About Arkansas Property Taxes H R Block

Where S My Arkansas State Tax Refund Taxact Blog

Homestead Tax Credit Real Property Aacd

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas State 2022 Taxes Forbes Advisor

Understanding Your Arkansas Property Tax Bill

2021 Tax Cut Legislation Arkansas House Of Representatives

Is There An Inheritance Tax In Arkansas

The Ultimate Guide To Arkansas Real Estate Taxes